5 Fascinating Learnings from Shopify at $6.8 Billion in Revenues

[ad_1]

So instances are nonetheless difficult for some, however the results aren’t even. One SaaS chief that’s accelerating once more is Shopify. At an virtually $7 Billion run-rate — they’re nonetheless rising a shocking 31% on a constant-currency foundation.

And that’s large acceleration from the post-Covid slowdown, when Shopify went from a loopy Covid-boosted 100% development, to a low-teens development price because it crossed $5 Billion run price.

That’s not simply fairly epic development at virtually $7 Billion in income, it’s one heck of a comeback.

Shopify development slowed dramatically post-Covid because the world reopened. A tricky transition.

But it surely roared again

Right now:

▶️ Nearly $7B run-rate

▶️ Rising a shocking 31% (!!)

▶️ Radically extra environment friendly, $600m+ adj working revenue run-rate

▶️ 29% of biz from enterprise (Plus)— Jason ✨Be Form✨ Lemkin (@jasonlk) October 10, 2023

5 Fascinating Learnings:

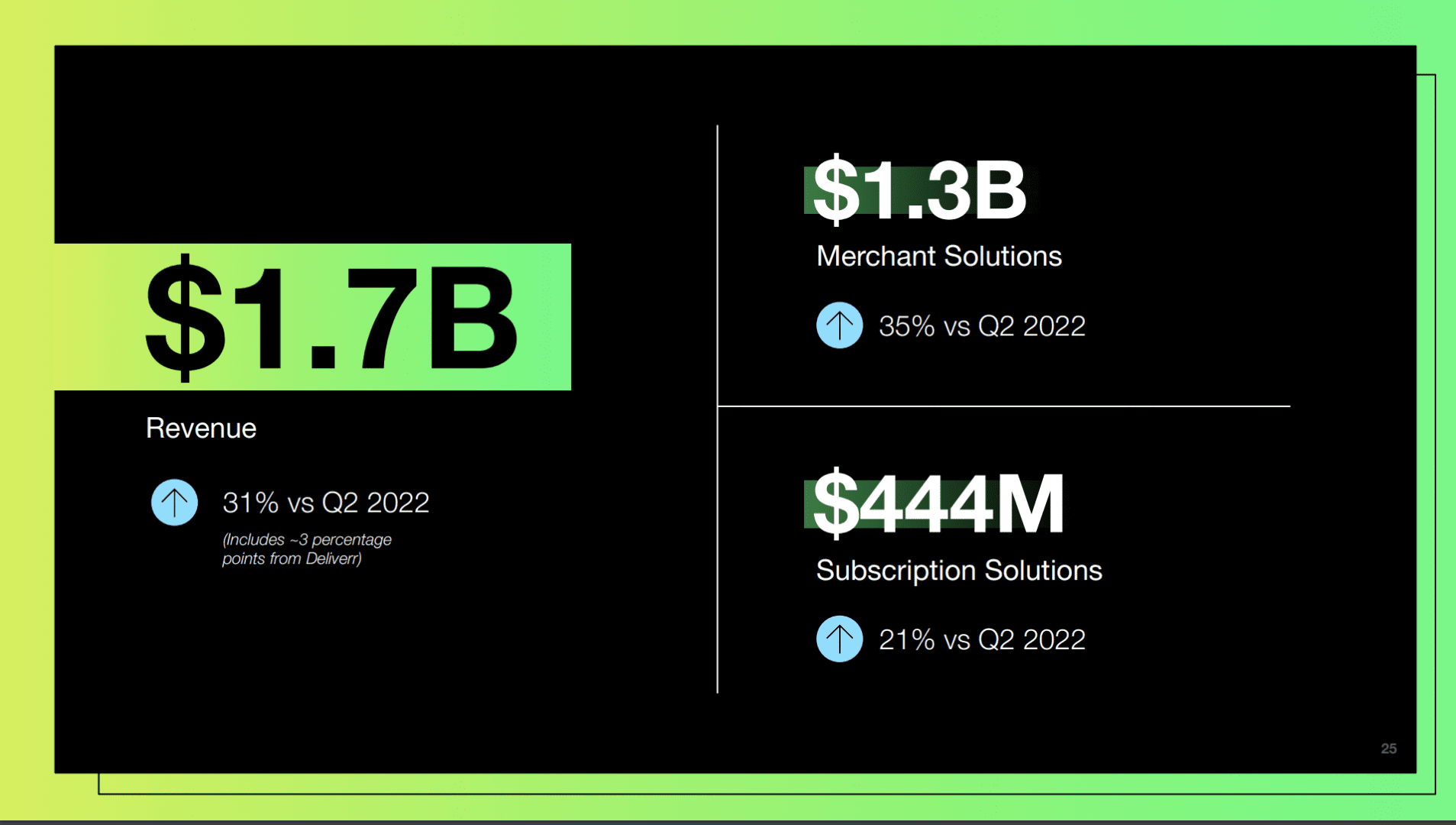

#1. Software program Essential. However a Smaller and Smaller Share of Income.

From a enterprise mannequin perspective, Shopify has in essence been a fintech and service provider product first and a SaaS product second for fairly a while. General subscription options income is up simply 21%, whereas funds and service provider options are up 35% — from a a lot, a lot bigger base.

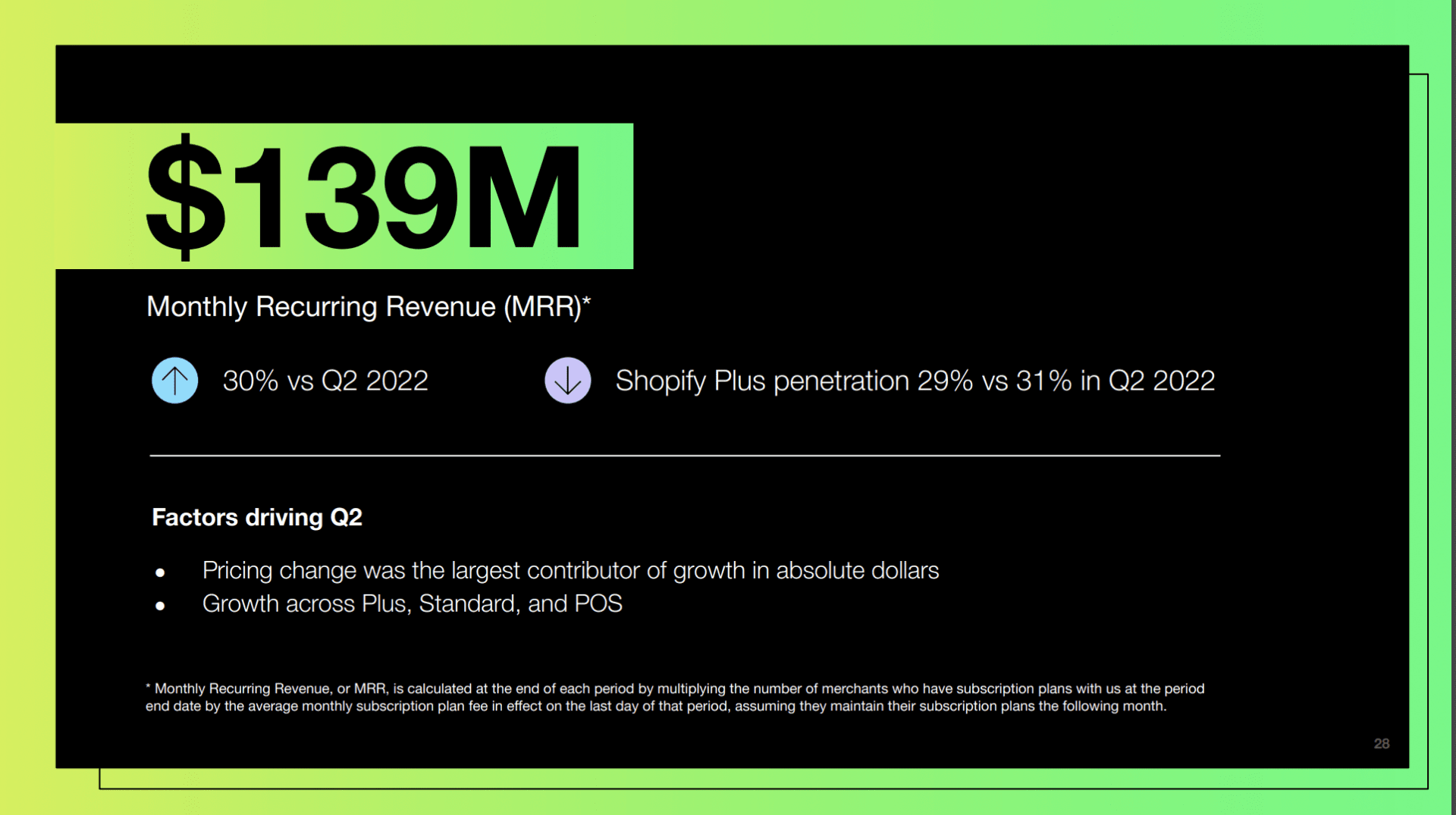

#2. Pricing Will increase Actually Boosted MRR.

MRR is as much as $139M, so ARR is as much as $1.7B of Shopify’s complete $6.8B in ARR. Shopify’s worth improve was the most important driver right here, and that ought to present up in subsequent twelve months of income development.

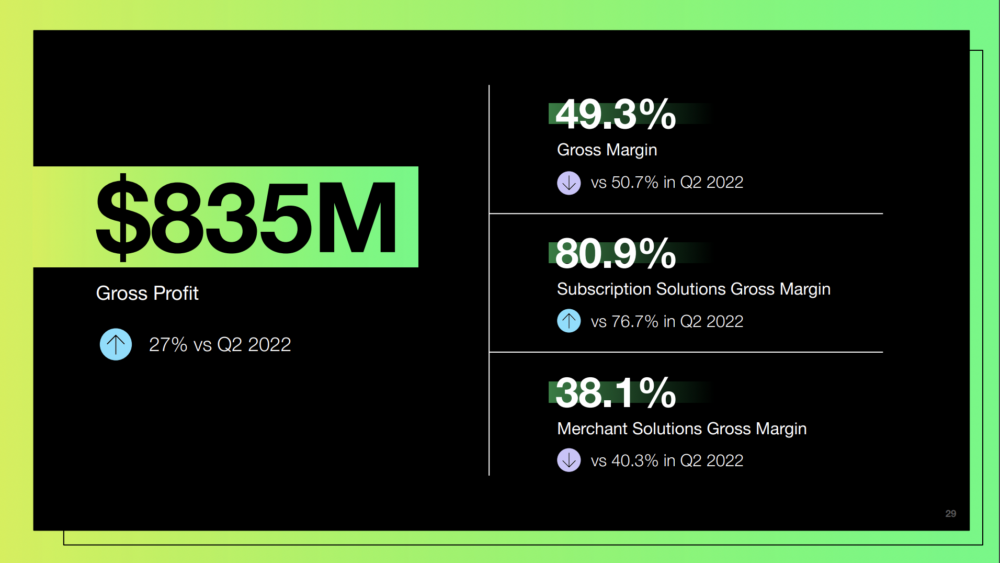

#3. 80% Margins on Software program, However Simply 38% on Funds and Service provider Options = 49.3% Gross Margins General

That is the problem from anybody that provides funds and fintech to SaaS. The highest line numbers will be large, however the margins are typically a lot decrease. At 49.3% gross margins, Shopify isn’t actually a software program firm anymore, really. It’s a hybrid payments-software play.

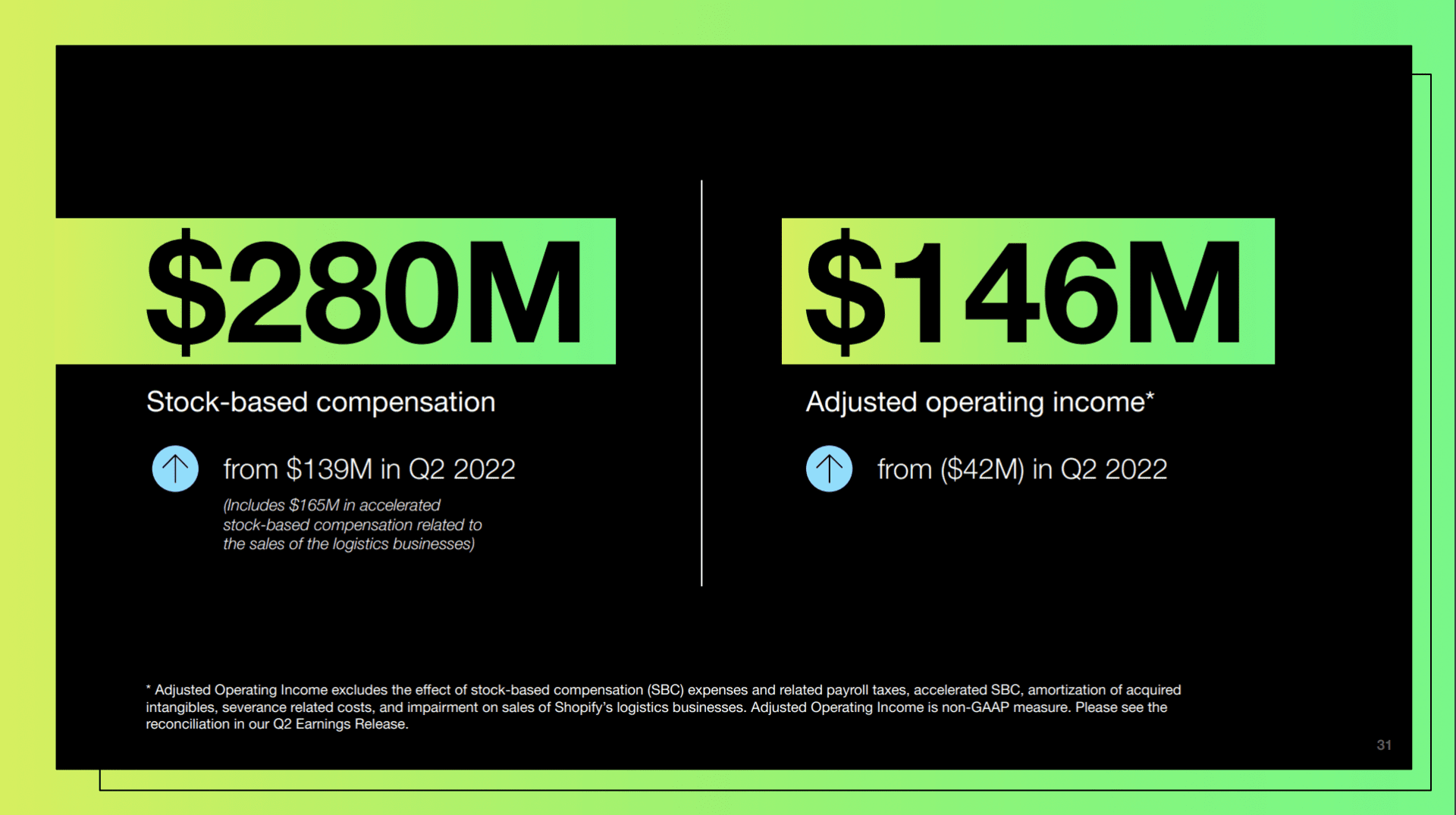

#4. Like Most Different SaaS Leaders, Shopify Has Gotten a Lot Extra Environment friendly.

In only one yr, its quarterly working revenue has swung from a comparatively modest however actual lack of -$42m, to +$156m in working revenue. Wow. Evening and day. Quarterly free money stream additionally went from -$87m to +97m in simply 12 months. A bit extra on how everybody from Monday to HubSpot to MongoDB have executed it right here. Key for Shopify is like Monday and others they’ve said their dedicated to rising working bills “considerably slower” than income going ahead. I.e., they’re gonna keep this environment friendly.

#5. “Shopify Plus”, Shopify’s Extra Enterprise Providing, Stays at about 29%-31% of Income.

Plus has taken off, however curiously, SMBs have scaled simply as rapidly, that means its p.c of Shopify’s general income hasn’t actually budged. Shopify could be a lot smaller if it hadn’t gone upmarket and pushed Plus an increasing number of. However the explosion of SMB commerce and the worth improve to the SMB Shopify plans has meant Plus income development hasn’t outpaced the general development of the corporate’s SMB base. Generally these things is a bit noninuitive.

And a bonus fascinating studying:

#6. 70% of Shopify Purchases are on Cell.

All of us type of knew this, principally, however 70% is a fairly excessive quantity!

[ad_2]