5 Fascinating Learnings from Snowflake at $2.4 Billion in ARR

[ad_1]

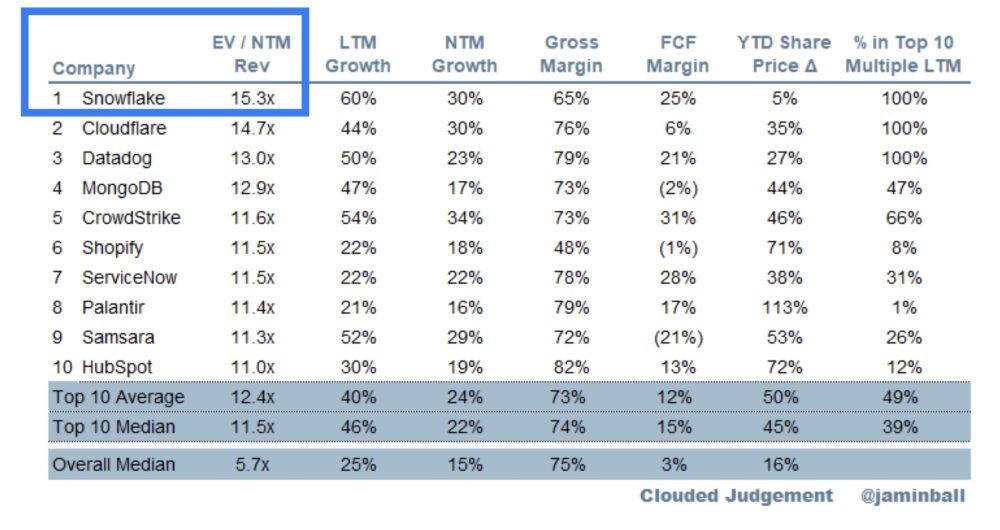

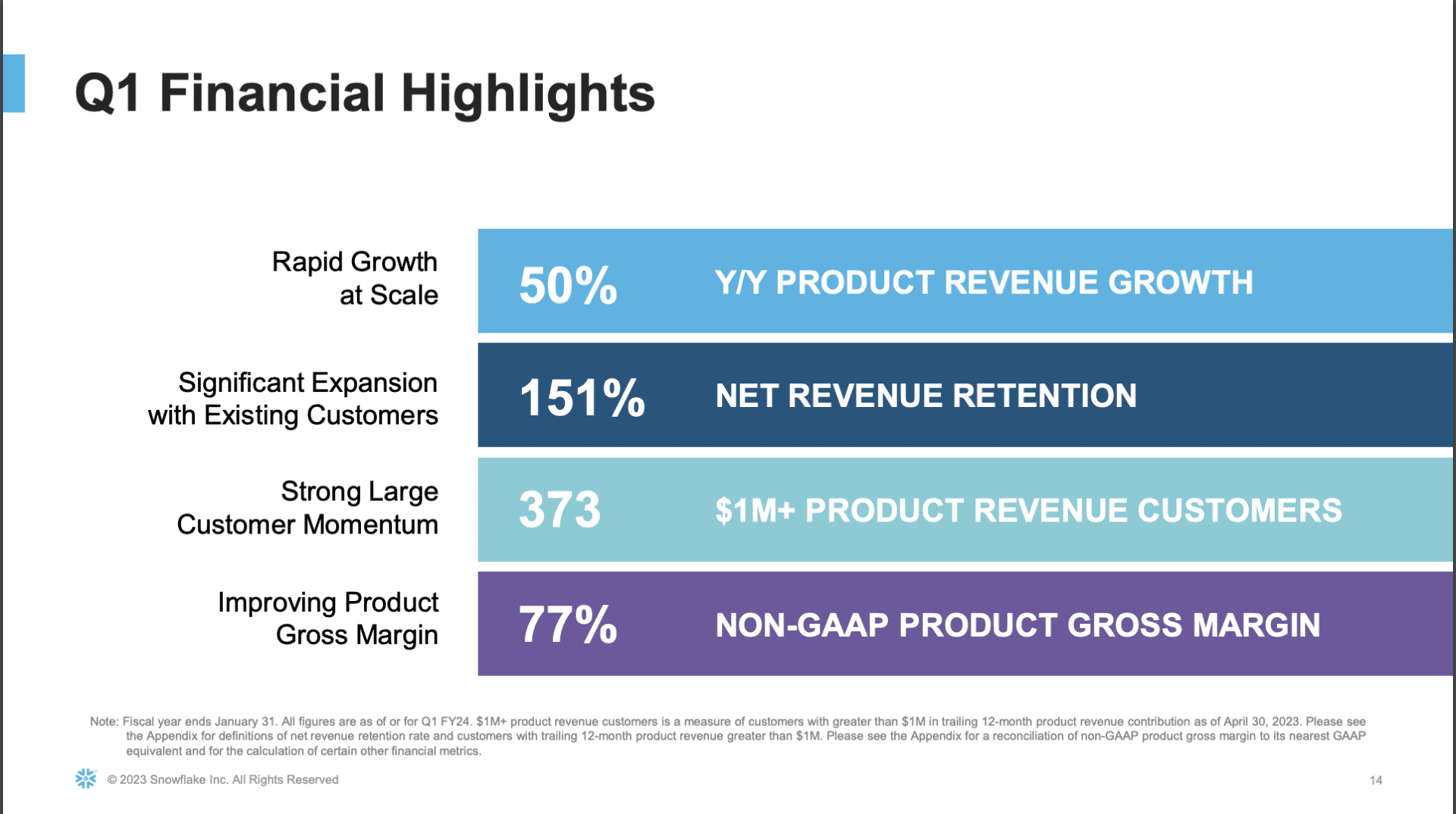

So Snowflake is the excessive flier in Cloud. It’s one of many few nonetheless commanding a premium a number of in in the present day’s world, and nonetheless rising at great charges:

Snowflake can be a barometer of every little thing in SaaS and Cloud, as a result of a big quantity of its income is consumption-based, a minimum of partly. So when CFOs and others tighten budgets, they’ll additionally attempt to purchase much less Snowflake. Not none, simply much less. AWS is seeing this, and so is Snowflake. Rising stays jaw-dropping at 50% at $2.4 Billion in ARR, however prospects are attempting to cut back their spend or a minimum of sluggish the rise in spend. Which simply is sensible.

5 Fascinating Learnings:

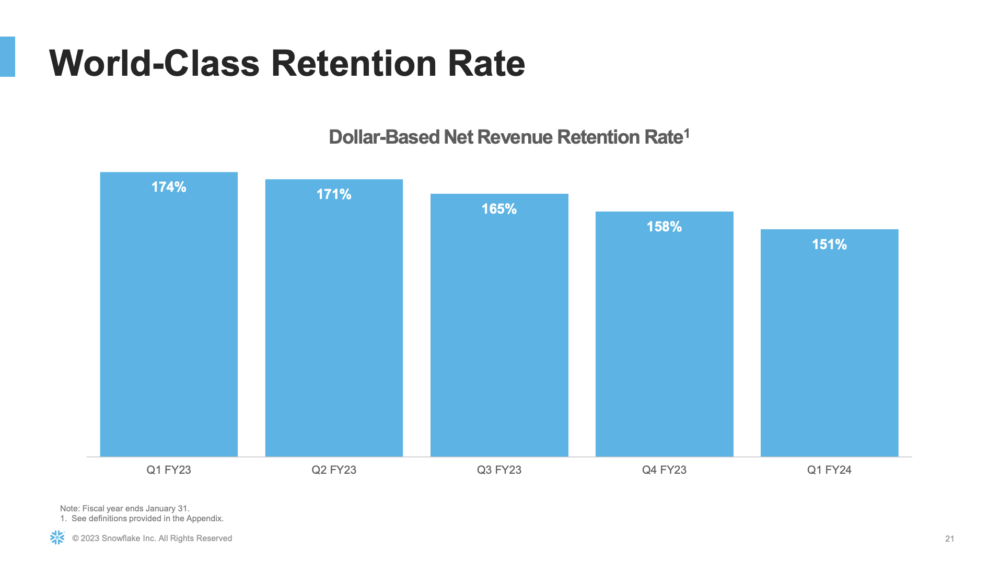

#1. NRR Stays Sturdy at 150%, however Down From 170%+ a Yr In the past. Extra proof of consumers, particularly large prospects, attempting to manage spend extra aggressively. 150% NRR continues to be prime decile. But it surely’s down from the just about loopy 170% of the previous few years. And from even only a 12 months in the past.

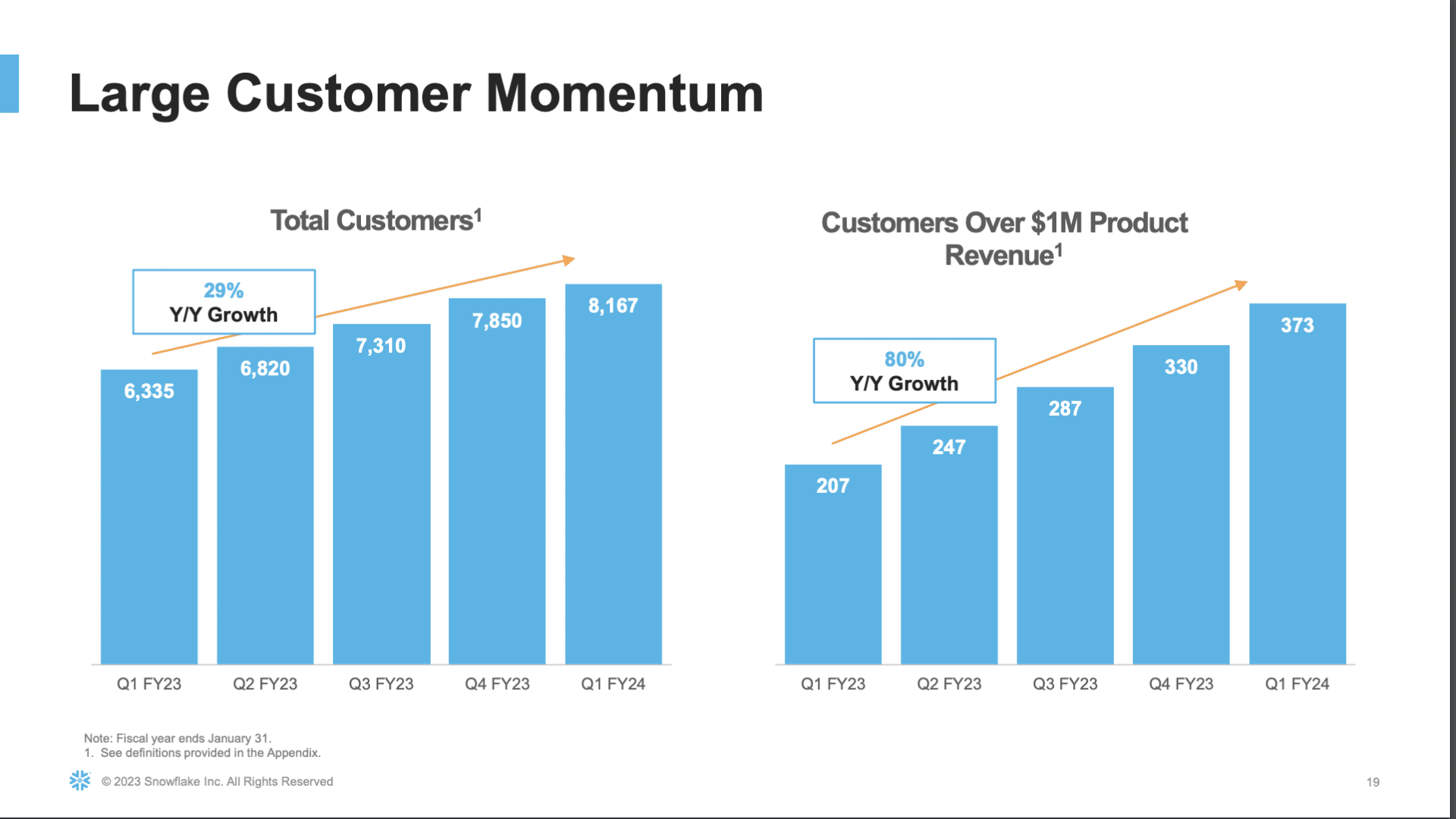

#2. It’s Virtually 400 $1M+ Clients Gasoline Development — They Are Rising 80%. General buyer development is 29%, fairly spectacular at $2.4 Billion in ARR. But it surely’s the $1M+ ones which might be fueling the large numbers at this scale. They’re rising 80%.

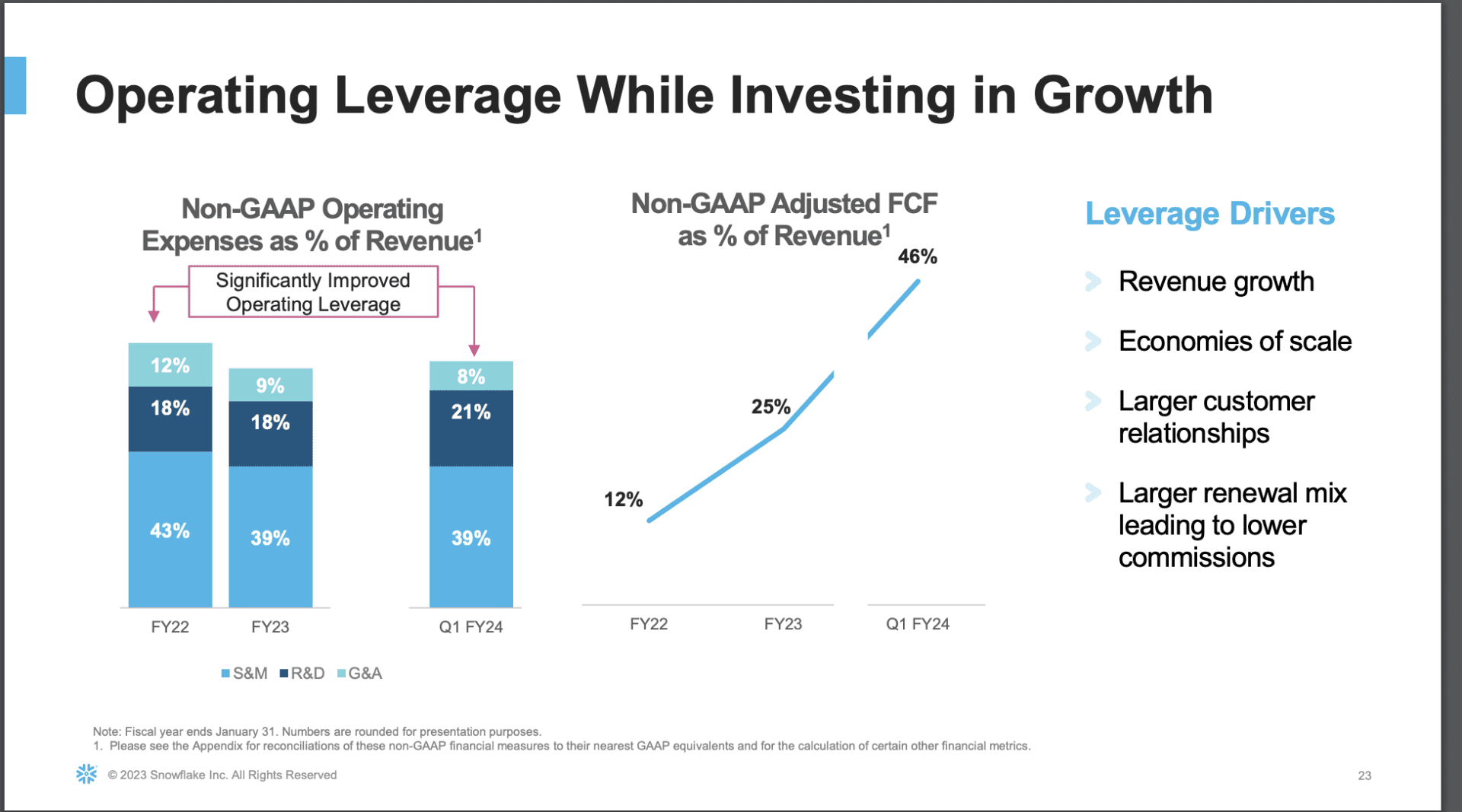

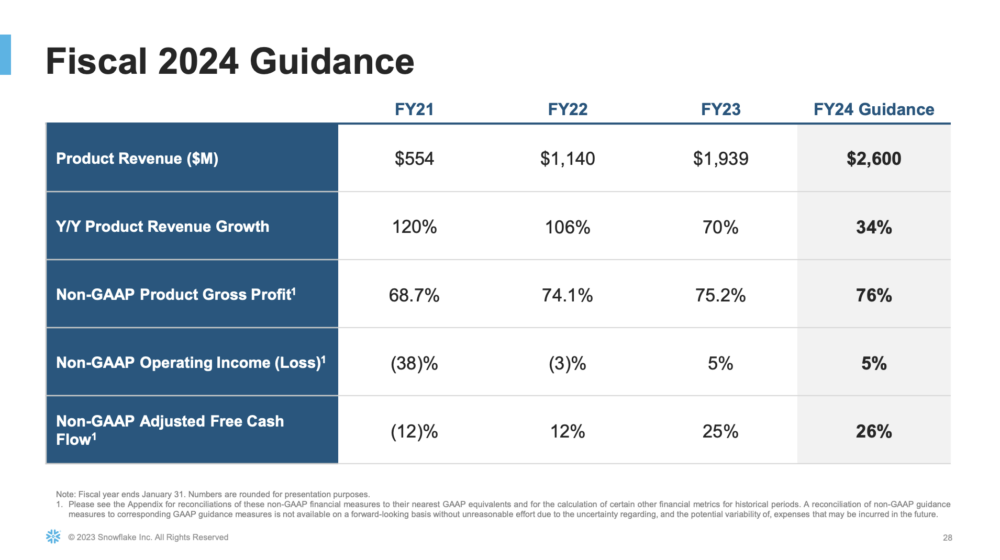

#3. Getting Radically Extra Environment friendly, With Non-Gaap Free Money Movement Doubling from 12% to 25% of Income. That is the theme of the day. Virtually each Cloud and SaaS chief is getting radically extra environment friendly, together with Snowflake. Not solely has its free-cash movement doubled in only one 12 months from 12% to 25%, however it’s predicting epic free money movement in 2024 of 46%. Wow. Everyone seems to be mainly doing extra with not way more headcount (see subsequent level).

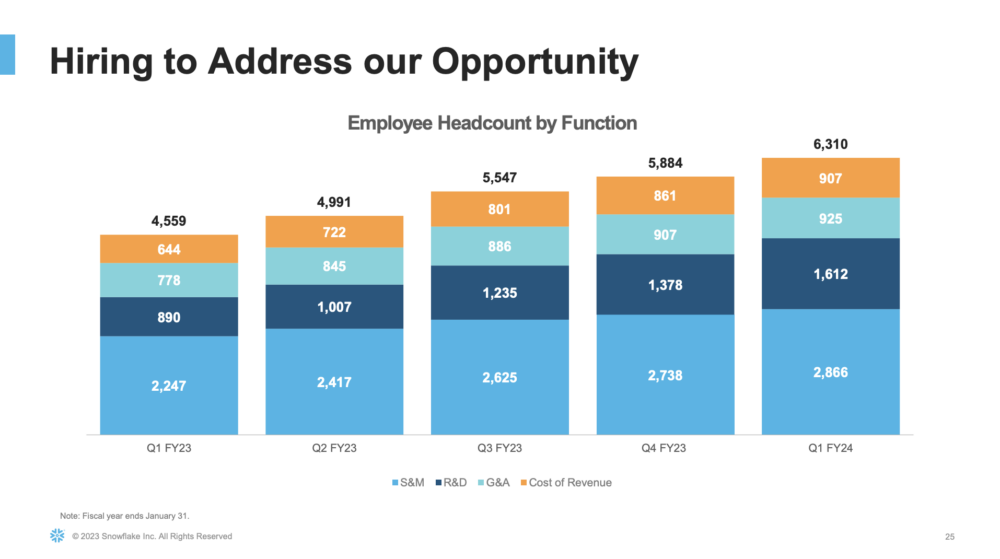

#4. Rising Headcount, However A lot Extra Slowly That Income. Headcount is up 29% year-over-year, however income is up 50%. That is the way you get extra environment friendly. Additionally you possibly can see gross sales & advertising and marketing headcount is mainly flat, whereas hiring is nearly all in engineering / R&D. We see a really related story at different cloud and SaaS leaders, too.

#5. Predicting a Conservative 36% Development in 2024. That is maybe the most important take-away, together with radical effectivity. Snowflake is being cautious for subsequent 12 months — they usually know. They see the information in actual time by way of utilization. They’re modelling “solely” 34% development for subsequent 12 months. Nonetheless unbelievable at their scale, however materially slower than this 12 months and far slower than the previous years.

And some different attention-grabbing learnings:

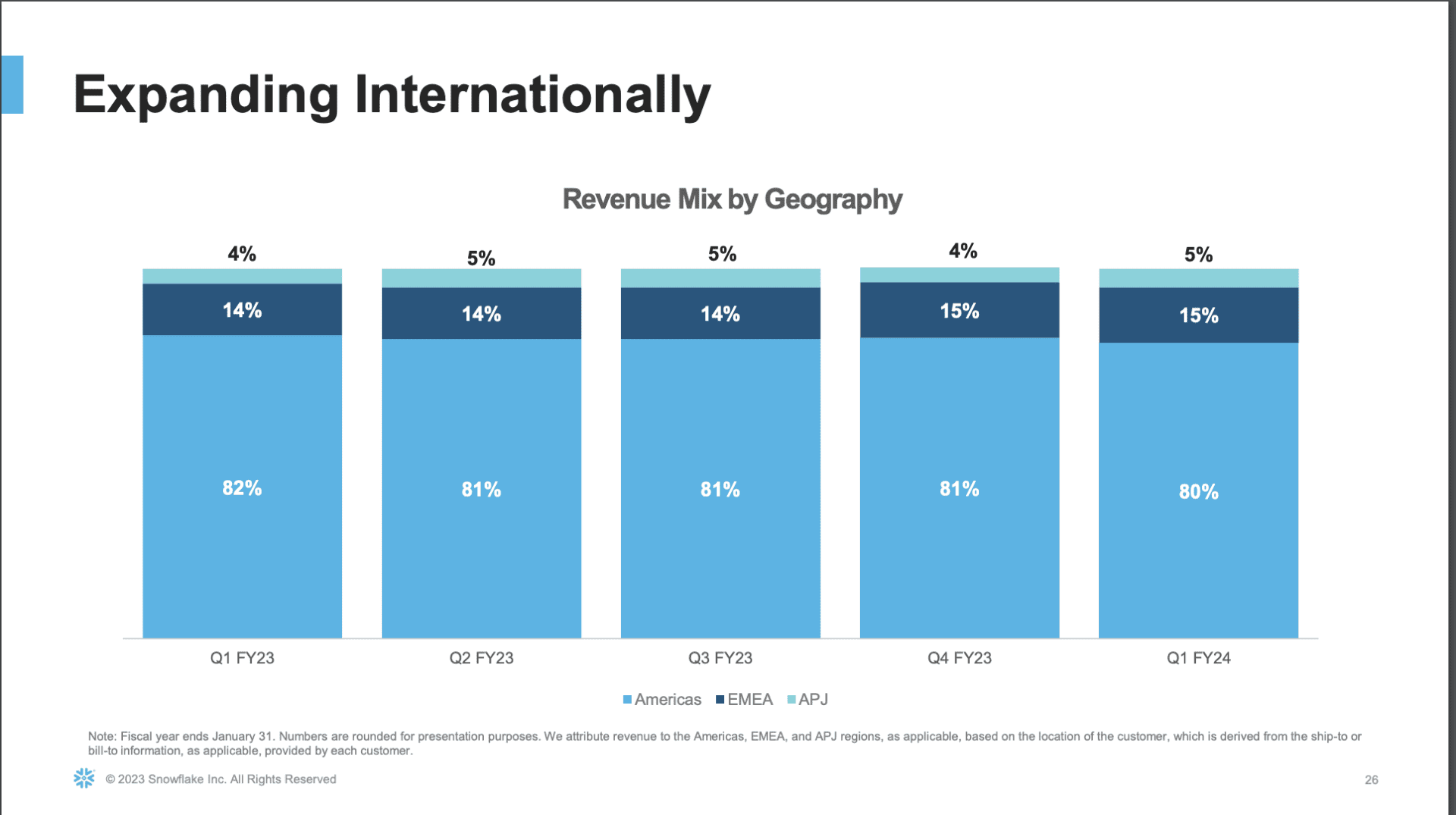

#5. Slowly However Absolutely Increasing Outdoors of North America. 80% of Snowflake’s income continues to be in North America. However that’s slowly coming down as worldwide ramps up.

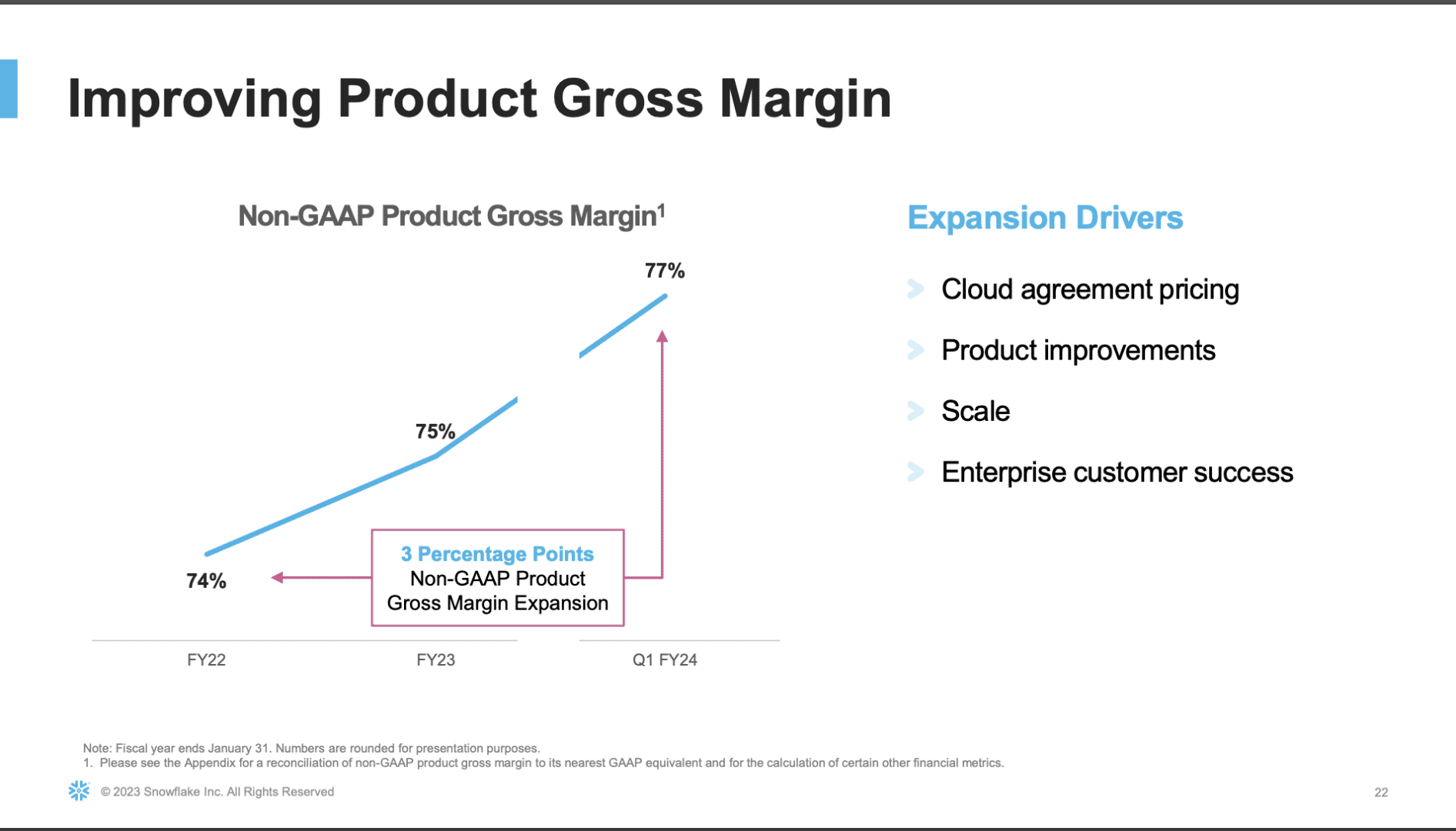

#6. Gradual and regular progress on gross margins, now at 77%. I’ve all the time been impressed with Snowflake’s margins. Given the huge quantity of compute and storage concerned, I’d have anticipated “lower than software program” gross margins. However no, gross margins are very spectacular, and Snowflake retains working at it. They plan for 77% gross margins subsequent 12 months, up from 74%.

Wow what an ideal story, and one all of us want to trace. Even when you solely play on the software layer, Snowflake is what so, so many people run on. And your prospects run on. So seeing what they’re seeing is sort of a magical perception into your prospects’ minds — and spend.

[ad_2]