Elevating Enterprise Capital in 2024? The Air is Very, Very Skinny Above $200,000,000 Valuations

[ad_1]

If I needed to summarize enterprise capital right now, it will be like this: There may be Very Little Oxygen At the moment Above $200m Valuations

What do I imply?

It’s nonetheless a bizarre world in enterprise:

- Corporations are each shutting down and elevating new funds.

- Extra entrepreneurs are doing direct investing themselves than ever.

- Unicorns are hurting, however — Nasdaq is at an all-time excessive.

So internet internet we nonetheless see very excessive ranges of seed funding. Of us are nonetheless hoping and dreaming that wager, as improbably because it is perhaps, might nonetheless do 100x-1000x and turning into the subsequent Datadog, Snowflake, Klaviyo, Samsara, Uber, and many others.

However the issue in SaaS particularly is that the typical public SaaS firm is buying and selling for about $2 Billion, and at about 6x ARR.

So what? Effectively no less than in principle, you’ll be able to nonetheless make 100x or extra at a $20m valuation if the corporate finally ends up value $2 Billion. Form of, in case you ignore dilution.

However how do you make 8x-10x on the later levels, Sequence B and on? It turns into mathematically very exhausting to make 8x-10x on any valuation in SaaS above $200m post-money.

Sure development buyers don’t count on each deal to do 8x-10x. However they do want a few of them to. And in the event that they don’t see no less than a transparent path to doubtlessly get there, it’s very exhausting to do the deal.

In 2021, with public SaaS shares buying and selling at 20x or extra, and lots of value $10B and even $100B, it was straightforward to see 8x-10x from even a $1B valuation. Therefore, so many unicorns.

At the moment, it’s simply a lot more durable for development buyers to see an 8x-10x final result previous a $200m valuation.

Web internet, we’re seeing a world the place seed stays vibrant, however every stage after that’s more durable.

And after a $200m valuation? You actually should >show< you’re an outlier right now to lift at that valuation. Not simply have some good causes to hope.

If nothing else, even after the Unicorn Bust and 18 months of powerful headlines, I discover most founders at Sequence A and later are nonetheless too optimistic about how exhausting it is going to be to lift the subsequent spherical. Simply belief me. Go discover out, ask round, ask your board and present buyers. Your present money could have to final even longer than you had been planning.

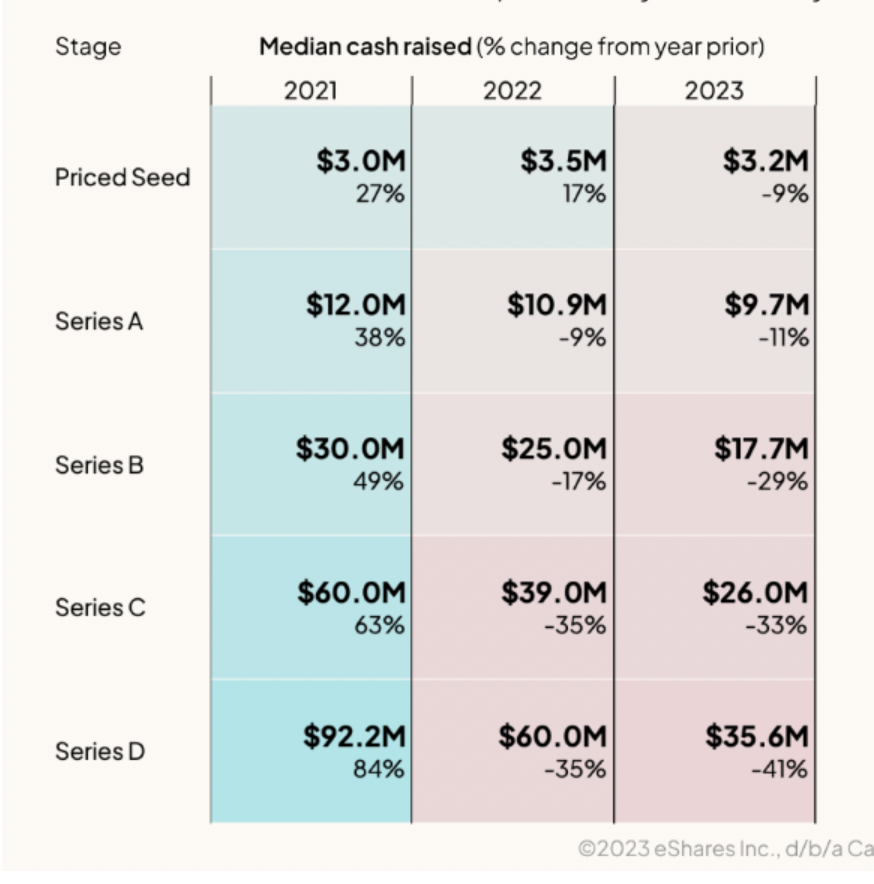

The latest Carta data I feel illustrates the purpose properly, though even there it might be too bullish, given how massive AI rounds have warped the information. Seed rounds are down -9% this yr. However Sequence D? -41%. I think in SaaS, it’s nearer to -80% with out AI hyped offers.

…

And a fantastic latest deep dive on VC SaaS investing right here:

[ad_2]