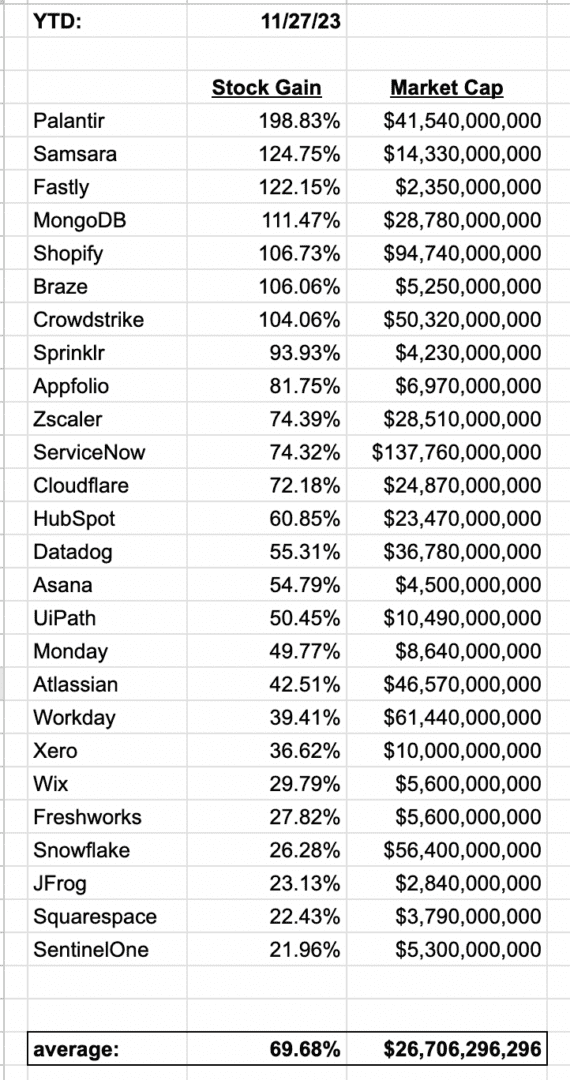

Occasions Are Powerful for Some. However — 25+ of The Main SaaS and Cloud Corporations Are Up 69% on Common This 12 months

[ad_1]

So no query many of us, particularly promoting gross sales and advertising instruments, are having a fairly robust time of it. Leaders we admire and look as much as from Zoominfo to Zoom to Field have had robust years on the inventory market, little question.

However not everybody. Not by far. Total, the BVP Nasdaq Rising Cloud Index is up 22.97% this yr.

I went additional and put collectively a fast listing of 25+ SaaS and Cloud leaders to see how their share costs are doing. On common, their share costs are up a surprising 68.50% and they’re value on common $26 Billion!

Now it’s not all smiles, daisies and glory. The ARR multiples in lots of circumstances right here aren’t all that prime. And the expansion for a lot of of those leaders has come means down this yr, even when normally, they’ve gotten much more environment friendly. And importantly, many are nonetheless means off their 2021 highs. The massive inventory worth swings in 2023 in lots of circumstances are nonetheless underneath their 2021 peak.

However nonetheless a reminder, quietly, this isn’t too unhealthy a yr or a time for a lot of SaaS and Cloud leaders. Not all. However many.

Virtually Everybody’s Gotten Radically Extra Environment friendly in SaaS

[ad_2]